Source: CNBC

U.S. stocks ended mixed in the shortened Christmas Eve session Thursday, holding most of the gains for a week in which commodities and beaten-down sectors of the market led.

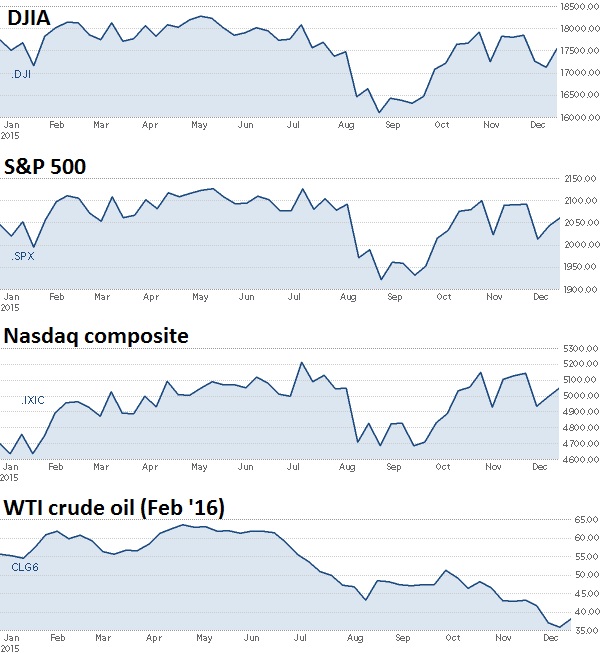

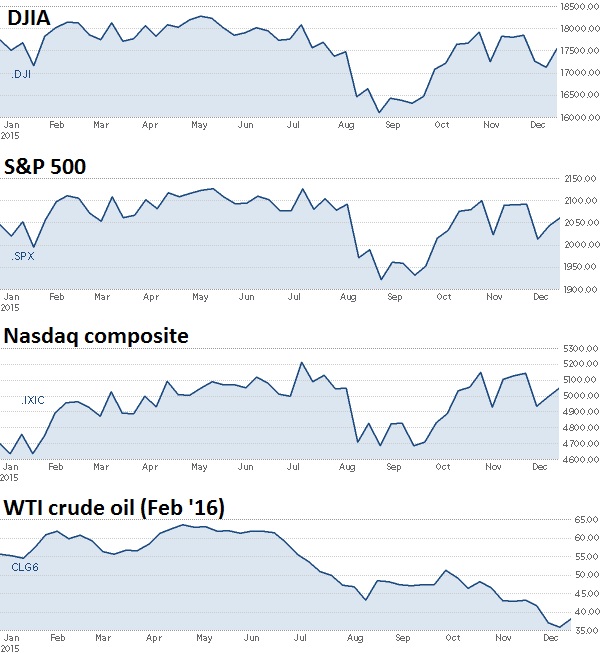

The major U.S. averages ended the week about 2.5 percent higher or more, their best week since the one ended Nov. 20.

"I think the big news of the week is Santa Claus has come to Wall Street early and brought us to break-even levels for the year," said Adam Sarhan, CEO of Sarhan Capital.

The question is whether that rally, led by some recovery in hard-hit areas of the market, will continue.

"I think today's really about retail. It's really the last day for (investors) to focus on the Christmas season," said JJ Kinahan, chief strategist at TD Ameritrade. He noted unseasonably warm weather in most of the United States may encourage more shopping on Dec. 26, a day he said has recently become more important for retail.

The SPDR S&P Retail ETF (XRT) closed down nearly 1 percent but held gains of more than 2 percent for the week.

"I think a lot of people were short coming into this week. (They're) positioning before the end of the year," Sarhan said. "Investors are looking for the next bullish catalyst out there."

U.S. stocks ended mixed in the shortened Christmas Eve session Thursday, holding most of the gains for a week in which commodities and beaten-down sectors of the market led.

The major U.S. averages ended the week about 2.5 percent higher or more, their best week since the one ended Nov. 20.

"I think the big news of the week is Santa Claus has come to Wall Street early and brought us to break-even levels for the year," said Adam Sarhan, CEO of Sarhan Capital.

The question is whether that rally, led by some recovery in hard-hit areas of the market, will continue.

The S&P 500 closed lower but held in the green for

2015 after ending there Wednesday. The index failed to hold intraday

attempts at gains as energy led all sectors except health care lower.

Energy closed down nearly 1 percent, holding gains of 4.6 percent for the week. The sector is still more than 20 percent lower for the year so far as the worst performer in the S&P 500.

The Nasdaq composite held slight gains as Facebook semiconductor and biotech stocks advanced.

The Dow Jones industrial average failed to hold intraday attempts at gains as Chevron, Exxon Mobil and Nike weighed.

Oil remained near multi-year lows, but extended recent gains. U.S. crude oil futures settled up 60 cents, or 1.60 percent, at $38.10 a barrel, for a 9 percent weekly gain. Brent was last trading just below $38 a barrel. Natural gas inventories declined slightly from the previous week, according to the EIA.

The stock market closed at 1 p.m., ET, for Christmas Eve and remains closed Friday for Christmas Day. Oil settled early at 1:30 p.m., and the bond market was scheduled for a 2 p.m. close.

Energy closed down nearly 1 percent, holding gains of 4.6 percent for the week. The sector is still more than 20 percent lower for the year so far as the worst performer in the S&P 500.

The Nasdaq composite held slight gains as Facebook semiconductor and biotech stocks advanced.

The Dow Jones industrial average failed to hold intraday attempts at gains as Chevron, Exxon Mobil and Nike weighed.

Oil remained near multi-year lows, but extended recent gains. U.S. crude oil futures settled up 60 cents, or 1.60 percent, at $38.10 a barrel, for a 9 percent weekly gain. Brent was last trading just below $38 a barrel. Natural gas inventories declined slightly from the previous week, according to the EIA.

The stock market closed at 1 p.m., ET, for Christmas Eve and remains closed Friday for Christmas Day. Oil settled early at 1:30 p.m., and the bond market was scheduled for a 2 p.m. close.

"I think today's really about retail. It's really the last day for (investors) to focus on the Christmas season," said JJ Kinahan, chief strategist at TD Ameritrade. He noted unseasonably warm weather in most of the United States may encourage more shopping on Dec. 26, a day he said has recently become more important for retail.

The SPDR S&P Retail ETF (XRT) closed down nearly 1 percent but held gains of more than 2 percent for the week.

"I think a lot of people were short coming into this week. (They're) positioning before the end of the year," Sarhan said. "Investors are looking for the next bullish catalyst out there."

No comments:

Post a Comment